Estate Law Direct Mail: Wills, Trusts, & Probate Client Acquisition for Modern Firms

Estate Law Direct Mail: Wills, Trusts, & Probate Client Acquisition for Modern Firms

1. Introduction: Targeted Direct Mail for Estate Law Leads

Buying a new home is more than just a transaction; it’s a monumental step, a significant investment, and for many, the foundation of a family’s future. This pivotal life event immediately highlights a critical, often unrecognized, need for estate planning. As an attorney, are you effectively reaching these new homeownerswith an innovative solution to protect their most valuable assets and secure their legacies?

In today’s competitive legal landscape, standing out and acquiring high-quality leads is paramount. Targeted direct mail offers an incredibly efficient and impactful way to generate precisely these kinds of estate law leads from new homeowners. This article will explore why this demographic is uniquely primed for estate planning services and how to craft sophisticated direct mail campaigns that convert inquiries into loyal, long-term clients for your firm. This is your ultimate playbook for legal lead generation.

2. Why New Homeowners Are Prime for Estate Planning Leads

The period immediately following a home purchase represents a golden opportunity for estate law firms. This demographic isn’t just seeking legal services; they are experiencing life-stage triggers that naturally compel them to consider their future and the protection of their assets and loved ones. These individuals often become qualified leads for your firm.

2.1. New Asset Protection (The Home)

For many, a new home represents the largest single asset they will ever own. This monumental investment often sparks a natural inclination to ensure its protection and proper distribution. Unlike liquid assets, real property has unique characteristics that necessitate specific legal planning. Homeowners want to understand:

- How to ensure the home passes seamlessly to their intended beneficiaries.

- How to avoid the complexities and costs of probate for this significant asset.

- How to protect their home from potential creditors or future legal challenges.

- The implications of joint ownership versus individual ownership on their estate.

This focus on safeguarding their new, substantial investment makes new homeowners inherently receptive to discussions about wills, trusts, and other estate planning tools. They are actively seeking solutions to secure their financial future, and their home is at the very core of this consideration.

2.2. Growing Families / Guardianship Needs

A new home often symbolizes a new chapter, which frequently includes family growth. Young couples buying their first home may be planning to start a family, or expanding families may be moving into a larger space. This immediate or anticipated family growth brings the crucial topic of guardianship needs to the forefront. Parents, especially those with young children, carry a deep concern for their children’s well-being and future. They want assurance that, should the unthinkable happen, their children will be cared for by individuals they trust, and their assets will be managed responsibly for their children’s benefit.

Direct mail allows you to tap into this profound parental instinct. Messages emphasizing the importance of designating guardianship and creating a comprehensive plan for their children’s future resonate deeply with new homeowners who are simultaneously building their physical home and their family’s foundation. It’s a need that often feels urgent and personal.

2.3. Life Stage Awareness (Mortgage, Future Planning)

Taking on a mortgage is a significant financial commitment that spans decades. This long-term obligation naturally shifts an individual’s focus towards future planning. The act of purchasing a home forces a broad assessment of financial stability, debt, and long-term goals. It’s a period of heightened financial awareness and responsibility.

This heightened awareness extends beyond finances to overall future planning. New homeowners are thinking about their careers, their retirement, their children’s education, and their long-term health. This holistic view of the future makes them uniquely open to considering how estate planning fits into their broader vision. The stability of a new home provides a grounding point from which to consider these crucial long-term legal strategies. They are in a mindset of proactive decision-making, which is ideal for engaging with estate law services.

3. Key Estate Law Services for New Homeowners

While the need for estate planning is clear, the specific services that resonate most with new homeownersoften revolve around protecting their family and their new asset. Your firm can tailor its outreach to highlight these critical areas.

3.1. Wills & Last Testaments

The Will is often the cornerstone of an estate plan and a fundamental document for new homeowners. It dictates not only the distribution of assets, including their new home, but also serves critical functions such as:

- Designating an executor: Choosing who will manage their estate.

- Nominating guardians: A vital provision for those with minor children, ensuring their care.

- Specifying funeral arrangements or charitable bequests: Providing clarity and peace of mind.

For new homeowners, especially first-time buyers or those with new family dynamics, a Will is an essential first step in asserting control over their future. Direct mail can effectively communicate the simplicity and profound importance of establishing a well-drafted Last Will and Testament.

3.2. Living Trusts vs. Testamentary Trusts

Beyond a basic Will, trusts offer more sophisticated estate planning options that are particularly appealing to new homeowners concerned with probate avoidance, privacy, and long-term asset management.

- Living Trusts: These allow assets, including the new home, to be transferred into the trust during the homeowner’s lifetime, avoiding the often lengthy and public probate process. They also offer flexibility for managing assets during incapacitation and can provide greater privacy.

- Testamentary Trusts: These are created within a Will and only come into effect upon death. They are useful for controlling asset distribution to beneficiaries, especially minors or those with special needs.

Educating new homeowners on the benefits of trusts – such as ensuring privacy, minimizing delays, and potentially reducing estate taxes – can be a powerful differentiator in your direct mail campaigns.

3.3. Guardianship Nominations for Children

For parents, the security of their children is paramount. While a Will can nominate a guardian, a standalone Guardianship Nomination or a more detailed provision within a comprehensive estate plan provides clear legal direction. This service is a non-negotiable for many new homeowners who have recently committed to building a family home. They want to ensure:

- Their children will be cared for by trusted individuals should anything happen to both parents.

- The transition for their children would be as smooth as possible, avoiding court battles over custody.

- Financial provisions for their children are clearly laid out.

Direct mail messaging that taps into these protective instincts, offering clear, actionable solutions for guardianship, can be incredibly effective in generating immediate inquiries.

3.4. Probate Avoidance & Planning

The word “probate” often conjures images of lengthy, costly, and public legal processes. Many new homeowners are vaguely aware of probate but lack a clear understanding of how to avoid it or minimize its impact. Offering solutions for probate avoidance is a highly valuable service.

Strategies your firm can highlight include:

- Using living trusts for major assets like the new home.

- Utilizing beneficiary designations on financial accounts.

- Exploring joint tenancy with rights of survivorship.

By emphasizing how proper estate planning can streamline the transfer of assets, protect family privacy, and minimize legal complexities and costs, your direct mail can provide immense relief and attract highly motivated clients seeking peace of mind.

4. Crafting Effective Direct Mail for Estate Law Leads: An Innovative Approach

The effectiveness of direct mail isn’t just about sending mail; it’s about strategic execution. Seasonal Mail Leads leverages an innovative approach to ensure your estate law campaigns yield optimal results.

4.1. Targeting Parameters: Pinpointing High-Value Homeowners

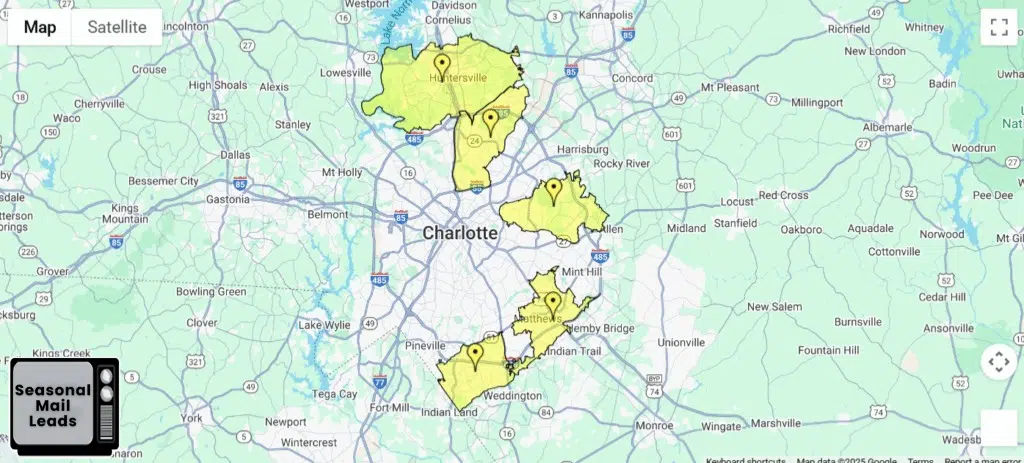

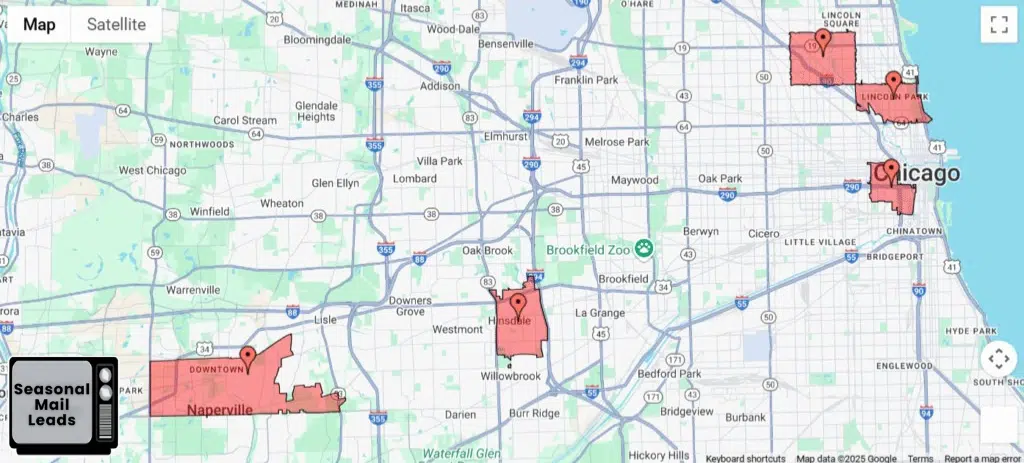

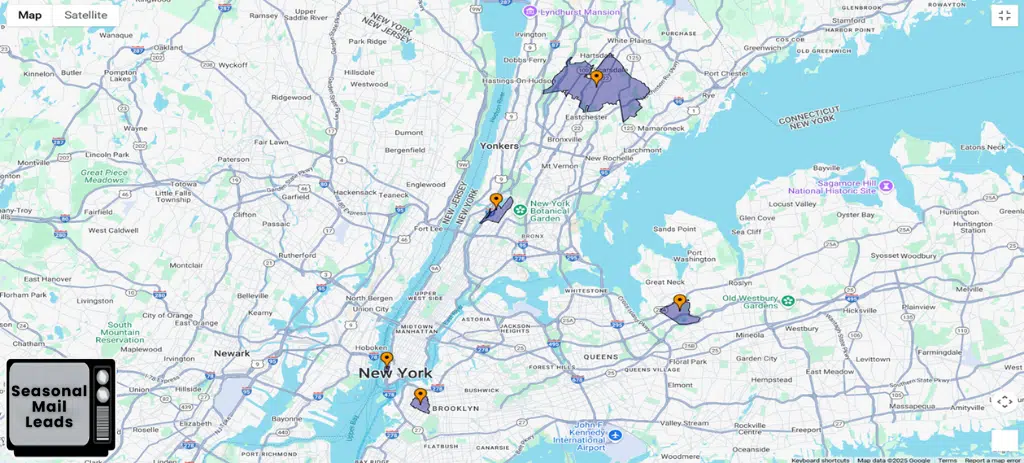

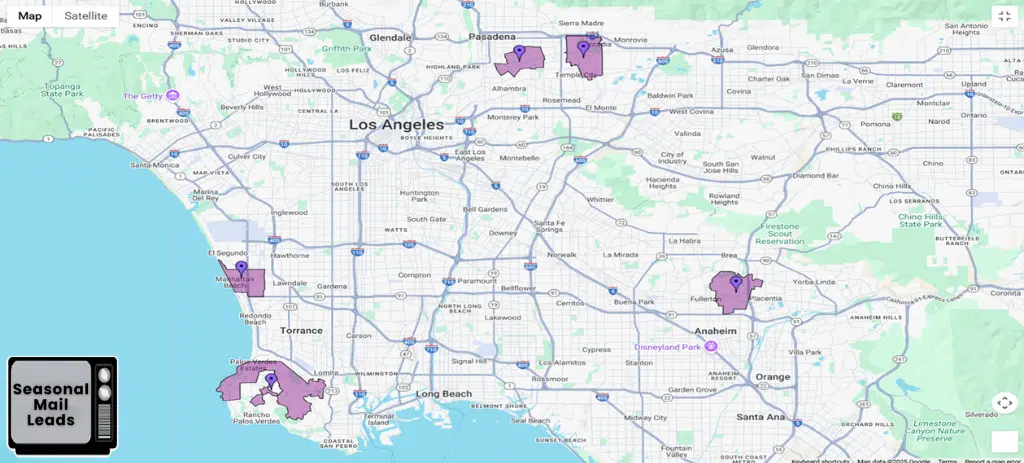

The cornerstone of successful direct mail for estate law is precision targeting. We go beyond simple demographics to identify individuals who are not just homeowners, but new homeowners with a clear propensity for estate planning needs. Our targeting parameters include:

- Recent Home Purchase Dates: We identify newly recorded deeds, allowing us to reach individuals within weeks or even days of their home purchase. This immediacy is crucial, as their minds are already on significant life changes and financial commitments.

- Property Values: Targeting homes within specific value ranges allows you to focus on clients who align with your firm’s ideal client profile and fee structure for comprehensive estate plans.

- Family Demographics: Data points such as marital status, presence of children (and their ages), and household income provide invaluable insights. This enables us to segment your audience and tailor messages specifically for young families needing guardianship, or established couples seeking advanced trust planning.

This granular level of data ensures that every piece of mail you send is highly relevant, maximizing your chances of reaching someone with an immediate, specific estate law need. It’s not about mass mailing; it’s about hyper-targeted, intelligent outreach.

4.2. Compelling Messaging & Offers: Delivering Immediate Value

Once you’ve identified your ideal audience, the message itself must resonate powerfully. For estate law, messaging should focus on peace of mind, family protection, and control over one’s legacy.

- Emotional Appeal: Connect with the homeowner’s desire to protect their family and ensure their children’s future. Use language that evokes security, responsibility, and love.

- Clarity and Simplicity: Avoid legal jargon. Explain complex concepts like probate avoidance or different trust types in easy-to-understand terms.

- Strong Value Proposition: Clearly articulate the benefits of proactive estate planning – saving time, reducing costs, avoiding family disputes, and securing a legacy.

Your direct mail offers should provide immediate value and lower the barrier to engagement. Consider:

- Free Consultations: A classic and highly effective offer, providing a low-risk opportunity for homeowners to discuss their specific needs.

- Complimentary Estate Planning Checklists: A valuable resource that educates prospects and positions your firm as an authority.

- Informative Webinars or Seminars: For more complex topics, offering a free educational event can attract a highly engaged audience.

- Downloadable Guides: “The New Homeowner’s Guide to Estate Planning” or “Protecting Your Children: A Guardianship Checklist.”

The key is to encourage immediate action by offering something tangible and useful that addresses their concerns, positioning your firm as the solution provider.

4.3. Visual Elements for Trust & Urgency: Beyond Just Words

The design and visual presentation of your direct mail piece are as crucial as the message itself. For estate law, these elements must build trust and convey a subtle sense of urgency without being alarming.

- Professional Design and Branding: A clean, elegant layout, consistent branding with your firm’s logo and colors, and high-quality paper stock all contribute to an image of professionalism and reliability.

- Empathetic Visuals: Use imagery that evokes family, security, peace of mind, and the warmth of a home. Photos of happy families, tranquil homes, or trusted advisors can create a strong emotional connection. Avoid overly complex or abstract legal imagery.

- Personalization: Beyond just the recipient’s name, personalized touches can include mentioning their new address or city. This creates a highly customized feel that grabs attention.

- Subtle Urgency: While you don’t want to create panic, gently remind them that life is unpredictable. Phrases like “Don’t delay securing your family’s future” or “Act now to protect your new investment” can encourage timely action without being pushy. Limited-time offers for consultations can also create gentle urgency.

- Clear Call to Action: The offer should be prominently displayed, easy to find, and provide clear instructions on how to respond (e.g., “Scan QR Code for Free Checklist” Scan QR Code for Free Checklist, “Call Now for Your Consultation” Call Now for Your Consultation, “Visit Our Website” Visit Our Website).

By thoughtfully integrating compelling visuals and a professional design, your direct mail becomes a powerful, tangible representation of your firm’s expertise and commitment to its clients.

5. Measuring Success & ROI in Estate Law Direct Mail

One of the significant advantages of direct mail, when executed strategically by a partner like Seasonal Mail Leads, is its inherent measurability. Demonstrating a clear return on investment (ROI) is vital for any law firm’s marketing budget.

5.1. Tracking Response Rates

To understand the immediate effectiveness of your campaigns, it’s crucial to diligently track response rates. This includes monitoring:

- Phone Calls: Use unique, dedicated phone numbers for each campaign to precisely track inbound calls generated specifically from the direct mail.

- Website Visits/Landing Page Traffic: Implement specific URLs or QR codes on your mail pieces that lead to dedicated website pages. This allows you to track traffic directly attributed to the mail.

- Form Submissions: If your landing pages include contact forms, track how many are completed.

- Mail-In Responses: For some demographics, a physical reply card might still be effective.

By monitoring these metrics, you gain immediate insight into which messages, offers, and targeting parameters are most effective in prompting an initial response.

5.2. Lead-to-Client Conversion Metrics

The ultimate measure of success isn’t just a response; it’s a retained client. This requires tracking the journey from initial inquiry to signed retainer. Key metrics include:

- Appointment Setting Rate: The percentage of leads that schedule an initial consultation.

- Consultation-to-Retainer Rate: The percentage of consultations that convert into paying clients.

- Average Case Value (ACV): Understanding the typical revenue generated from an estate law clientacquired through direct mail.

By analyzing these conversion metrics, your firm can fine-tune its intake process, refine its offers, and optimize its overall client acquisition strategy. Seasonal Mail Leads works with you to provide the data necessary for this comprehensive analysis.

5.3. Long-Term Value of Estate Clients

Unlike some transactional legal services, estate planning often leads to enduring, multi-generational client relationships. The long-term value of an estate law client can be substantial:

- Ongoing Relationship: Estate plans often require updates due to life changes (births, deaths, marriages, new assets, changes in law). A well-serviced client will return to your firm for these revisions.

- Probate and Trust Administration: If your firm handles probate or trust administration, the initial estate planning work can directly lead to future, higher-value engagements.

- Referrals: Satisfied clients are your best advocates. They will refer family, friends, and colleagues who also need estate planning services, creating a virtuous cycle of client acquisition.

- Multi-Generational Clients: As your clients age, their children and grandchildren may seek your firm’s services based on the trust established with the original client.

Recognizing this long-term value reinforces the ROI of your direct mail investment. It’s not just about a single case; it’s about building a sustainable pipeline for your firm’s future.

6. Getting Started with Your Ultimate Playbook

The market of new homeowners is continuously regenerating, offering a consistent and fresh stream of potential clients with undeniable estate law needs. By embracing a targeted direct mail strategy powered by Seasonal Mail Leads, your firm can proactively tap into this lucrative market, acquiring exclusive leads that convert into robust, long-term client relationships.

Consider the compounding potential:

- Estate planning clients who return for updates as their families grow and assets evolve.

- Families who, having trusted you with their estate plan, now turn to you for probate or trust administration.

- Satisfied clients who become valuable referral sources, extending your reach organically.

This is more than just transactional legal lead generation; it’s about building a sustainable pipeline of high-value clients who view your firm as their trusted legal partner for generations.

Don’t let the opportunity to serve these highly motivated new homeowners pass by. Don’t wait for them to search blindly amidst the digital noise. Reach out to them directly, personally, and at the precise moment they need your expertise.

Call to Action:

Ready to secure a consistent flow of high-quality Estate Law leads?

- Request Your FREE Sample Postcard Request Your FREE Sample Postcard specifically designed for Estate Law client acquisition.

- Speak with an Expert Speak with an Expert to develop a tailored Estate Law Lead Strategy for your firm.

Let Seasonal Mail Leads help you write the next chapter of your firm’s success story.

7. Conclusion: Exclusive Legal Leads from Targeted Direct Mail

The dream of a new home is universal, and with it comes a distinct set of legal considerations, particularly in the realm of estate law. While digital marketing has its place, the ultimate playbook for acquiring exclusive legal leads from this valuable demographic lies in the strategic, data-driven power of direct mail.

Seasonal Mail Leads offers a distinct advantage, delivering precision-targeted campaigns that resonate with new homeowners’ immediate and anticipated needs for estate planning. From safeguarding their assets through comprehensive wills and trusts to securing guardianship for their children and ensuring probate avoidance, your firm’s expertise is not just desired, but critical.

By leveraging sophisticated data, compelling design, and an unwavering focus on measurable results, Seasonal Mail Leads transforms the physical mailbox into a direct conduit for high-intent inquiries. It’s an approach that builds trust, establishes authority, and cuts through the digital clutter, ensuring your firm is top-of-mind when new homeowners seek legal guidance to protect their most cherished investments and loved ones.

It’s time to move beyond the traditional. Embrace the ultimate playbook. Discover how targeted direct mail, powered by Seasonal Mail Leads, can consistently deliver the exclusive legal leads your firm needs to thrive and become the trusted legal partner for every new homeowner embarking on their exciting new beginning.